Crypto30x.com is designed for those looking to achieve massive gains in the cryptocurrency market. With a focus on smart asset selection and advanced trading strategies, the platform helps users navigate the volatile world of crypto. Whether you’re a beginner or an experienced trader, Crypto30x.com equips you with the tools and insights to aim for 30x returns. Ready to unlock your potential in the crypto space? Read on to discover how Crypto30x.com can transform your trading journey.

2. Key Features of Crypto30x.com

Crypto30x.com stands out by offering a set of powerful tools and features designed to help users maximize their returns in the ever-changing cryptocurrency market. Below is a breakdown of the key features that make this platform a must-have for investors aiming for substantial gains.

Strategic Asset Selection

One of the core strengths of Crypto30x.com lies in its sophisticated asset selection process. The platform uses a combination of data-driven algorithms and expert analysis to identify high-potential cryptocurrencies before they experience significant growth. This ensures that users can invest in assets with the potential for massive returns, instead of chasing after trends or speculation.

How it Works:

- Data-Driven Insights: Crypto30x.com analyzes historical data, market trends, and emerging technologies to pick the best performing assets.

- Early Entry Advantage: By pinpointing assets before they surge, investors can benefit from early entry, maximizing their profit potential.

- Diverse Opportunities: The platform doesn’t limit users to just the top coins like Bitcoin or Ethereum, but also explores altcoins that are gaining momentum in specific sectors like DeFi, NFTs, and Layer-2 solutions.

Market Timing and Trend Analysis

Timing is everything in cryptocurrency investing. Crypto30x.com provides users with cutting-edge market timing tools and trend analysis features that enable them to identify the best moments to enter or exit the market.

Key Features:

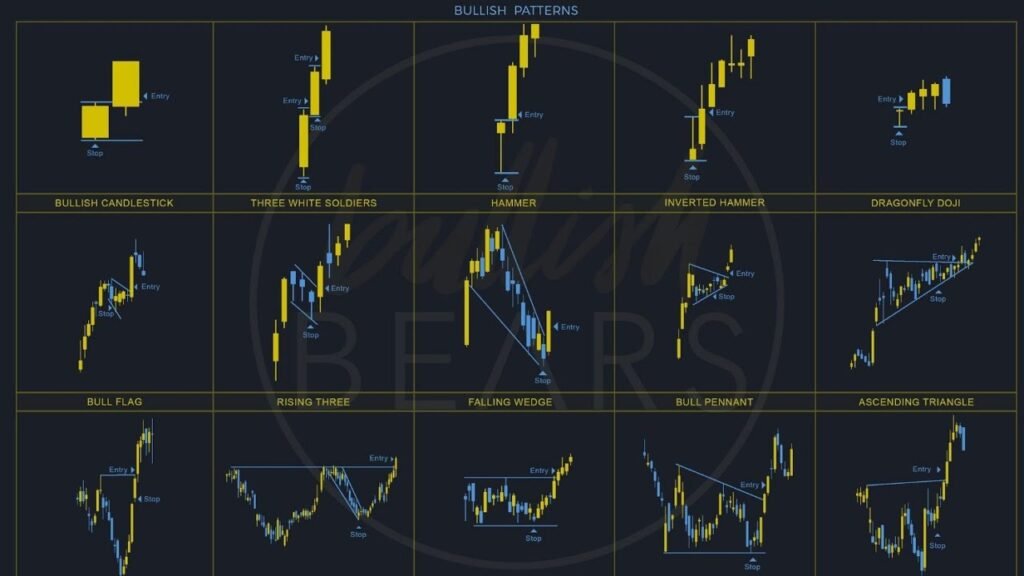

- Trend Identification: Advanced charting tools help users spot bullish or bearish trends, allowing them to make informed decisions.

- Automated Alerts: Crypto30x.com offers notifications when specific market conditions occur, such as price breakouts or sudden shifts, ensuring users stay informed of critical opportunities.

- Sentiment Analysis: The platform also scans news, social media, and crypto communities to assess market sentiment, adding an extra layer of intelligence for predicting potential price momentum changes.

Leverage Options for Maximizing Gains

Crypto30x.com offers leverage trading, allowing users to multiply their potential profits by controlling larger positions with less capital. While leverage trading carries risks, it can significantly enhance returns when used correctly.

How Leverage Works on Crypto30x.com:

- Customizable Leverage Levels: Users can choose their leverage level based on their risk tolerance, from conservative 2x leverage to higher-risk, high-reward 20x leverage.

- Risk Management Tools: The platform integrates risk management features such as automatic stop-loss orders and margin calls to help users mitigate losses when trading with leverage.

- Advanced Trade Execution: Crypto30x.com ensures fast, reliable trade execution, even during high-volume market events, so users can capitalize on quick market movements.

Explore Further :https://americannewswave.com/french-stream-moe/

Technical and Fundamental Analysis Tools

To further enhance investment decisions, Crypto30x.com offers a range of tools for both technical and fundamental analysis. These features allow users to conduct thorough research before making trades, improving their chances of success.

Technical Analysis Tools:

- Charting Software: Users can access a variety of technical indicators like Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Fibonacci retracements.

- Pattern Recognition: The platform automatically identifies classic chart patterns (such as head and shoulders, triangles, or double tops/bottoms) and alerts users when these patterns form.

Fundamental Analysis Tools:

- Market Capitalization Tracking: Stay informed about market cap changes and how they influence coin rankings.

- Development Activity: Track the progress of a cryptocurrency’s development and updates, offering insights into its long-term viability.

- On-Chain Metrics: Crypto30x.com provides valuable on-chain data such as transaction volume, number of active addresses, and token holder distribution to inform more robust investment decisions.

Customizable Dashboard

Crypto30x.com provides a fully customizable dashboard where users can monitor their investments, track specific assets, and set personalized alerts. This feature ensures that traders can tailor the platform to meet their unique needs and preferences.

Benefits:

- Real-Time Updates: Get live market data and asset prices right on your dashboard, allowing for informed decision-making in real-time.

- Portfolio Management: Monitor your entire portfolio’s performance, including real-time profit and loss tracking.

- Personalized Alerts: Set custom notifications for price targets, market conditions, or key indicators, ensuring you’re always aware of the next big opportunity.

3. How Crypto30x.com Helps Achieve 30x Gains

Crypto30x.com is designed to provide traders and investors with the tools and strategies needed to potentially realize significant returns, up to 30x. While such returns are rare and require a strategic approach, the platform’s methodology is structured to help users maximize their opportunities for growth. Let’s dive into how Crypto30x.com supports this journey to achieving 30x gains.

Identifying High-Potential Cryptocurrencies

One of the core methods to achieving high returns in the crypto market is identifying assets with explosive growth potential before they become mainstream. Crypto30x.com excels at this through a combination of cutting-edge technology and expert analysis.

Key Processes:

- Data-Driven Asset Research: The platform utilizes algorithms and machine learning to scan the crypto landscape for coins that are undervalued but show promise based on metrics such as market cap, trading volume, and development activity.

- Expert Insights: In addition to automated analysis, Crypto30x.com has a team of cryptocurrency experts who regularly evaluate emerging projects. These experts look at factors such as the team behind the project, the use case of the coin, and the overall market fit to determine whether a coin has the potential to skyrocket.

- Altcoin Focus: While many platforms focus heavily on major players like Bitcoin and Ethereum, Crypto30x.com specifically highlights smaller, less-known altcoins with high growth potential. These coins often provide the most significant opportunities for large gains.

By giving users access to such detailed analysis and insights, Crypto30x.com helps investors get in early on assets that are likely to experience exponential growth.

Strategic Market Timing

Timing the market correctly is critical for maximizing profits, especially in a volatile environment like cryptocurrency. Crypto30x.com equips users with the tools needed to pinpoint the right times to enter or exit trades, helping them capitalize on market cycles.

How Crypto30x.com Supports Market Timing:

- Trend Analysis Tools: The platform provides advanced trend analysis, allowing users to identify when a particular asset or the entire market is showing bullish or bearish signals. This helps traders make informed decisions about when to buy, sell, or hold.

- Market Sentiment Tracking: Crypto30x.com monitors crypto sentiment across various sources like news outlets, social media, and major forums to gauge how the general public and key influencers feel about certain cryptocurrencies. Market sentiment often precedes price movements, so this data is invaluable for timing investments.

- Real-Time Alerts: The platform enables users to set up personalized alerts based on their market timing strategy. These alerts can notify users of significant price changes, news events, or shifts in market trends, ensuring they never miss an important moment to act.

By using these market timing tools, users can maximize their profits by buying low and selling high, enhancing their chances of achieving substantial gains.

Leveraging Volatility for Gains

While volatility in the cryptocurrency market can scare off some investors, Crypto30x.com teaches users how to harness that volatility to generate substantial profits. High volatility presents opportunities for rapid gains when managed properly.

Leverage Options and Tools:

- Leveraged Trading: Crypto30x.com offers leveraged trading, where users can amplify their positions by borrowing funds. This feature allows traders to control more significant positions with less capital, enabling larger potential profits on successful trades.

- Example: With 10x leverage, an investor only needs to provide 10% of the trade’s value, but they get the benefit of 100% of the price movement. If the asset’s price rises by 5%, their leveraged position would yield a 50% gain.

- Risk Management Integration: While leverage increases the potential for gains, it also comes with higher risk. Crypto30x.com mitigates this by providing users with integrated risk management tools like stop-loss orders, which automatically close trades if the price moves unfavorably.

- Volatility Alerts: Users can also set up volatility alerts that notify them when an asset is experiencing significant price swings. This feature helps investors act quickly and capitalize on sudden market changes.

Diversified Asset Exposure

One key aspect of achieving high gains in crypto is diversifying investments across various types of assets. Crypto30x.com supports diversification by offering access to a wide range of cryptocurrencies, including established coins and emerging altcoins.

Benefits of Diversification on Crypto30x.com:

- Portfolio Stability: By investing in a mix of assets, users reduce the risk of significant losses if one coin underperforms, while still maintaining exposure to potential high-gain assets.

- Exposure to Growth Sectors: Crypto30x.com curates investment opportunities in emerging sectors such as decentralized finance (DeFi), non-fungible tokens (NFTs), and Layer-2 solutions. These sectors often see explosive growth, providing high-return potential.

- Customizable Portfolios: The platform allows users to create and manage their portfolios, tracking the performance of each asset in real-time. With tools to rebalance portfolios automatically, users can ensure they are always optimizing their exposure to profitable opportunities.

Real-World Success Stories

To further illustrate how Crypto30x.com helps achieve 30x gains, the platform showcases success stories of users who have experienced significant returns by using its tools and strategies. These case studies serve as real-world proof that the right combination of strategic asset selection, market timing, and leverage can yield exceptional results.

Examples:

- User A: Identified a promising altcoin using Crypto30x.com’s early detection tools and invested before the market recognized its potential. The coin later saw a 40x price increase, delivering massive profits.

- User B: Leveraged market timing and sentiment analysis to sell during a peak bull run, locking in a 30x gain on their initial investment.

- User C: Used the platform’s diversified asset approach, gaining exposure to multiple high-growth coins, which collectively resulted in a 25x return over a six-month period.

4. Navigating Volatility and Market Risks

Cryptocurrency markets are notoriously volatile, with price swings that can occur within hours or even minutes. While volatility presents opportunities for profit, it also comes with significant risks. Crypto30x.com is built to help users not only identify potential gains but also manage and mitigate the risks inherent in such a volatile market. In this section, we’ll explore how Crypto30x.com helps users navigate volatility and market risks to protect their investments and maximize returns.

Understanding Market Volatility

Before diving into the specific tools and strategies provided by Crypto30x.com, it’s essential to understand the nature of cryptocurrency volatility. Unlike traditional assets like stocks or bonds, cryptocurrencies are influenced by a variety of factors that can cause sharp fluctuations, including:

- Market Sentiment: Prices often react quickly to changes in investor sentiment, driven by news, regulations, or influential opinions.

- Liquidity Issues: Smaller market caps and lower liquidity can result in dramatic price movements for certain altcoins.

- Technological Changes: Upgrades, forks, or disruptions in blockchain technology can also have immediate effects on price stability.

- Speculative Trading: The crypto market sees a high level of speculation, often leading to rapid price increases or declines as traders react to short-term market conditions.

Crypto30x.com offers various features to help users navigate this dynamic environment by balancing the potential for high returns with effective risk management strategies.

Tools for Managing Market Risks

Crypto30x.com provides users with several built-in tools specifically designed to manage and reduce risks. These tools enable investors to make more informed decisions and shield themselves from large, unexpected losses.

Stop-Loss Orders

- How It Works: A stop-loss order automatically sells a cryptocurrency when its price drops to a predetermined level. This tool helps protect investors from major losses by exiting trades before the market falls further.

- Why It’s Important: In a fast-moving market, it’s easy to miss crucial price drops. Stop-loss orders take the emotion out of trading by executing automatically, ensuring that losses are minimized, especially during periods of high volatility.

Take-Profit Orders

- How It Works: Similar to stop-loss orders, take-profit orders automatically sell a position when it reaches a certain price level. This allows traders to lock in profits before the market has a chance to reverse.

- Why It’s Important: Cryptocurrencies often experience quick price spikes that may not last. Take-profit orders ensure that users can capture gains at the right time, avoiding the risk of holding too long in a volatile market.

Position Sizing

- How It Works: Crypto30x.com encourages users to diversify their investments by distributing their capital across multiple assets. This concept, known as position sizing, helps reduce exposure to any single coin or market event.

- Why It’s Important: Over-investing in a single cryptocurrency can lead to significant losses if that coin underperforms. By spreading investments across a range of assets, users can reduce the impact of volatility on their overall portfolio.

Volatility Alerts and Notifications

Crypto30x.com’s volatility alert system helps users stay informed in real-time about rapid changes in the market. These notifications enable investors to act quickly in response to sudden market shifts, ensuring that they can take advantage of opportunities or protect themselves from unexpected downturns.

Key Features:

- Price Alerts: Users can set up custom price alerts for specific cryptocurrencies. When the price reaches a certain threshold, Crypto30x.com will send a notification, enabling users to make timely decisions about entering or exiting the market.

- Volatility Alerts: These alerts notify users when a cryptocurrency experiences unusually high volatility, giving them the chance to review their positions and take necessary actions, such as adjusting stop-loss orders or selling a portion of their holdings.

Leveraging Hedging Strategies

One of the more advanced features offered by Crypto30x.com is the ability to hedge against market volatility. Hedging involves taking positions in other assets to offset potential losses in a primary investment.

How It Works:

- Incorporating Stablecoins: Investors can allocate a portion of their portfolio to stablecoins, such as USDT (Tether) or USDC, which are pegged to traditional currencies like the US dollar. Stablecoins offer a way to “park” assets during periods of high volatility, reducing exposure to price swings.

- Inverse Market Exposure: Crypto30x.com allows users to invest in assets that perform well in a bear market, such as inverse tokens or short positions. These assets rise in value when the broader crypto market declines, helping to balance losses during downtrends.

Why It’s Important:

Hedging strategies give users the ability to safeguard their portfolios during periods of market instability. By diversifying into stable assets or taking opposite positions, users can reduce the overall risk of their portfolio while still maintaining exposure to high-growth opportunities.

Diversification and Risk Mitigation of Crypto30x.com

Diversification is a cornerstone of risk management, and Crypto30x.com facilitates diversified investments across a range of cryptocurrencies and sectors. By spreading investments, users can mitigate the risks of individual asset volatility.

Diversification Strategies Supported by Crypto30x.com:

- Sector-Based Diversification: Users can diversify across different crypto sectors, such as DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and Layer-2 solutions. Each sector behaves differently depending on market conditions, providing balance to a portfolio.

- Altcoin Exposure: Crypto30x.com offers a wide range of altcoins that allow investors to capture growth opportunities outside the top coins like Bitcoin and Ethereum, while also diversifying risk.

- Geographical Diversification: Some cryptos are more popular in specific regions or are subject to regional regulations. Crypto30x.com offers insight into how geographical factors might influence certain assets, helping users make more balanced investment choices.

Monitoring Market Sentiment and News of Crypto30x.com

Market sentiment plays a significant role in cryptocurrency price movements, often leading to sudden increases or decreases based on public perception, news, or regulations. Crypto30x.com integrates sentiment analysis tools that help users gauge the overall mood of the market, which is crucial for making informed decisions.

Sentiment Tracking Features:

- Social Media Monitoring: Crypto30x.com scans platforms like Twitter, Reddit, and major crypto forums to provide insight into how the community is reacting to certain coins or market events.

- News Aggregation: The platform compiles news from top financial and crypto media outlets, ensuring that users are always up to date on the latest developments. Crypto30x.com’s news feed also includes regulatory announcements, market reports, and expert opinions.

- Market Sentiment Scores: Crypto30x.com assigns sentiment scores to various assets, giving users a quick snapshot of whether the market is feeling bullish, bearish, or neutral about a particular coin.

By staying ahead of market sentiment and news developments, users can anticipate potential price movements and adjust their strategies accordingly.

Final Thoughts on Navigating Volatility and Market Risks

Volatility and risk are unavoidable in the cryptocurrency market, but with the right tools and strategies, they can be managed effectively. Crypto30x.com provides users with a comprehensive suite of risk management tools, from stop-loss orders and take-profit settings to advanced hedging and diversification strategies. By equipping users to handle the ups and downs of the crypto market, Crypto30x.com helps traders protect their portfolios while still pursuing significant gains.

5. Beginner’s Guide to Using Crypto30x.com

Crypto30x.com is designed to be user-friendly, even for those who are new to cryptocurrency trading. Whether you’re just starting out or looking to explore the platform for the first time, this guide will walk you through the essential steps to get up and running on Crypto30x.com. We’ll cover how to set up an account, navigate the dashboard, and make your first trade with confidence.

Getting Started with Crypto30x.com

The first step to using Crypto30x.com is to set up your account. The process is simple and ensures you have secure access to all the tools and features the platform offers.

Create Your Account of Crypto30x.com

- Sign-Up Process: Visit the Crypto30x.com homepage and click on the “Sign Up” button. You’ll be prompted to enter your email address, create a password, and agree to the terms of service.

- Email Verification: After submitting your information, you’ll receive a verification email. Click the link in the email to activate your account.

- Two-Factor Authentication (2FA): For enhanced security, Crypto30x.com strongly recommends enabling 2FA. This feature ensures that even if someone gains access to your password, they will still need a second authentication step (such as a code sent to your phone) to log in.

KYC Verification

- Why It’s Required: As part of regulatory compliance, Crypto30x.com requires users to complete a Know Your Customer (KYC) verification process. This step helps prevent fraud and ensures the platform remains safe for all users.

- How to Complete KYC: You’ll need to submit identification documents, such as a government-issued ID (passport, driver’s license, etc.) and a proof of address (utility bill or bank statement). The process typically takes 24 to 48 hours for approval.

Your Wallet

- Deposit Methods: Once your account is verified, you can fund it using various deposit methods, including bank transfers, credit/debit cards, or cryptocurrencies.

- Supported Currencies: Crypto30x.com accepts a wide range of fiat currencies (USD, EUR, etc.) and cryptocurrencies (Bitcoin, Ethereum, etc.) for deposits.

- Security: All deposits are protected by industry-standard encryption, ensuring that your funds remain secure while they are transferred into your account.

Navigating the Crypto30x.com Dashboard

After setting up your account, the next step is to familiarize yourself with the Crypto30x.com dashboard. This dashboard serves as your control center, giving you access to all the essential tools for tracking markets, managing trades, and monitoring your portfolio.

Dashboard Overview of Crypto30x.com

- Portfolio Summary: At the top of your dashboard, you’ll see a summary of your portfolio, including the current value of all your assets, your profit/loss, and the percentage change in value over time.

- Watchlist: Below the portfolio summary is your custom watchlist, where you can track the performance of specific cryptocurrencies that interest you. You can add or remove assets from this list as needed.

- Market Overview: This section shows real-time data on the top-performing cryptocurrencies. You can sort the list by market cap, volume, or percentage change to identify the most promising opportunities.

- Recent Trades: The dashboard also displays a history of your recent trades, providing a quick overview of your trading activity and outcomes.

Customization Options of Crypto30x.com

- Custom Alerts: You can set price alerts for any cryptocurrency on your watchlist. When the price reaches your specified threshold, you’ll receive an email or in-app notification.

- Layout Customization: The dashboard is fully customizable, allowing you to rearrange widgets, add or remove sections, and tailor the layout to your preferences.

Making Your First Trade for Crypto30x.com

Once your account is funded, you’re ready to start trading on Crypto30x.com. The platform offers an intuitive trading interface that makes it easy for beginners to place their first trades with confidence.

1st Step

- Asset Selection: Navigate to the “Markets” section and browse the available cryptocurrencies. You can use the search bar to find specific coins or filter by categories such as “Top Gainers,” “New Listings,” or “DeFi Projects.”

- Research Tools: Before placing a trade, use the platform’s research tools to analyze the asset. Review charts, check market sentiment, and explore historical performance data to make an informed decision.

2nd Step

- Buy or Sell: Once you’ve chosen an asset, click on the “Trade” button. You’ll be prompted to select either “Buy” or “Sell” depending on your desired action.

- Order Types: Crypto30x.com supports multiple order types, including:

- Market Order: Instantly execute a trade at the current market price.

- Limit Order: Set a specific price at which you want to buy or sell the asset. The order will only be executed if the price reaches your target.

- Stop-Loss Order: Protect your investment by setting a stop-loss order, which automatically sells the asset if its price drops to a certain level.

3rd Step

- Preview: After entering your trade details, review the order to ensure everything is correct, including the asset, order type, and the amount you’re buying or selling.

- Confirmation: Click “Confirm” to execute the trade. Your order will appear in the “Recent Trades” section of your dashboard, where you can track its progress.

Learning the Basics of Technical Analysis for Crypto30x.com

For beginners, understanding the basics of technical analysis can significantly improve trading outcomes. Crypto30x.com provides several user-friendly tools to help newcomers grasp these concepts.

Key Concepts:

- Moving Averages (MA): These are one of the most popular indicators, used to smooth out price data and identify trends. A simple moving average (SMA) is calculated by taking the average price of an asset over a set period.

- Relative Strength Index (RSI): RSI is a momentum indicator that measures the speed and change of price movements. An RSI above 70 indicates an asset is overbought, while an RSI below 30 suggests it is oversold.

- Support and Resistance Levels: Support refers to a price level where an asset tends to stop falling, while resistance refers to a price level where it tends to stop rising. Understanding these levels helps traders determine entry and exit points.

Crypto30x.com offers detailed tutorials and visual guides to help users understand and apply these technical indicators when trading.

Managing Your Risk for Crypto30x.com

As a beginner, managing your risk is critical. Crypto30x.com provides built-in features to help you minimize losses and protect your capital.

Risk Management Tips:

- Start Small: Begin with a small portion of your total funds, especially if you’re still learning the platform. As you gain confidence, you can gradually increase your position sizes.

- Diversify Your Investments: Instead of putting all your money into one cryptocurrency, diversify your portfolio by investing in multiple assets. This reduces the risk of losing everything if one asset underperforms.

- Use Stop-Loss Orders: Always set stop-loss orders to protect yourself from sudden market drops. These orders automatically sell your asset if the price falls below a certain level, preventing major losses.

Final Thoughts for Beginners of Crypto30x.com

Crypto30x.com is designed to be an accessible platform for beginners entering the world of cryptocurrency trading. With a simple sign-up process, intuitive dashboard, and easy-to-use trading features, new users can quickly get started while learning the ropes of the crypto market. By following this guide, beginners can confidently navigate the platform, make informed decisions, and begin their journey towards successful crypto investing.

As you continue to explore Crypto30x.com, take advantage of its educational resources, risk management tools, and portfolio diversification options to enhance your trading experience.

6. Advanced Features for Experienced Traders of Crypto30x.com

Crypto30x.com isn’t just for beginners; it also caters to seasoned traders looking for advanced tools and features that help optimize strategies and maximize returns. For experienced users, the platform offers a comprehensive suite of features designed to take cryptocurrency trading to the next level. In this section, we’ll explore the advanced functionalities that make Crypto30x.com a robust platform for professional and high-volume traders.

Leveraged Trading for Enhanced Profits

One of the most powerful features available to advanced traders on Crypto30x.com is leveraged trading. This tool allows users to borrow funds to increase their position size, magnifying both potential profits and risks.

How Leveraged Trading Works:

- Amplified Gains: Leverage allows you to control a larger position with a smaller initial investment. For example, with 10x leverage, an investment of $1,000 allows you to control $10,000 worth of cryptocurrency. This amplifies the potential gains if the trade moves in your favor.

- Leveraging Long or Short Positions: Advanced traders can use leverage not only to go long (bet on a price increase) but also to go short (bet on a price decrease). This flexibility enables profits in both bullish and bearish markets.

- Risk Management Tools: Crypto30x.com incorporates strict risk management options like margin calls and liquidation warnings to prevent losses from spiraling out of control. If your position’s value drops too much, a margin call is triggered, requiring you to add more funds or reduce your leverage.

Strategies for Experienced Traders:

- Scalping: Leveraged trading is highly effective for short-term strategies like scalping, where traders aim to profit from small price movements by entering and exiting trades rapidly.

- Swing Trading: With larger positions, swing traders can hold leveraged positions for a few days or weeks to capture bigger price movements while using risk management tools to protect against significant losses.

Advanced Charting and Technical Analysis Tools

Experienced traders rely heavily on technical analysis to make informed trading decisions, and Crypto30x.com provides a full suite of charting and analysis tools to meet these needs.

Key Charting Features:

- Multiple Time Frames: View charts across different time frames, from minute-by-minute data for scalpers to weekly or monthly charts for long-term investors.

- Customizable Indicators: Crypto30x.com offers a variety of technical indicators, including moving averages, Bollinger Bands, MACD, RSI, and Fibonacci retracement levels. Users can apply these indicators to charts and customize settings to match their trading strategies.

- Drawing Tools: Users can draw trend lines, channels, and other shapes directly on the charts to mark support and resistance levels, chart patterns, or key price zones. These tools allow for better visual representation of potential trade opportunities.

Specialized Indicators for Advanced Traders:

- Ichimoku Cloud: This advanced indicator provides multiple insights into an asset’s momentum, trend direction, and support/resistance levels in a single glance, making it particularly useful for experienced traders.

- Volume Profile: Analyze the distribution of trading volume over time to identify significant price levels where large amounts of buying or selling have occurred. This is useful for spotting potential reversal points or breakouts.

Customizable Trading View:

- Multi-Chart Layouts: Advanced users can set up multiple charts for different assets or timeframes within a single screen. This is ideal for monitoring several markets simultaneously and spotting arbitrage opportunities.

- Backtesting Tools: Crypto30x.com allows users to backtest their strategies by applying technical indicators to historical data. Traders can refine their strategies and evaluate how well they would have performed in past market conditions.

Automated Trading Strategies

For experienced traders looking to automate their strategies, Crypto30x.com offers API integration and access to trading bots. These tools are invaluable for high-frequency traders or those using algorithmic trading strategies.

Trading Bots:

- Algorithmic Trading: Experienced traders can set up bots to execute trades automatically based on pre-defined criteria, such as price triggers, volume changes, or technical indicator signals. Bots are particularly useful in volatile markets where fast execution is crucial.

- 24/7 Trading: The cryptocurrency market never closes, which makes automation essential for traders who want to capitalize on opportunities around the clock without being tied to their screens.

- Customizable Strategies: Crypto30x.com offers the flexibility to build custom trading bots based on specific strategies. Traders can program bots to execute scalping strategies, arbitrage trades, or even portfolio rebalancing.

API Integration:

- Direct Market Access: Through Crypto30x.com’s API, advanced users can connect their external trading software or custom-built algorithms directly to the platform. This allows for high-speed execution, data streaming, and custom functionalities that enhance trading efficiency.

- Data Access: The API also gives users real-time access to market data, enabling them to build custom analytics or integrate third-party tools for enhanced performance tracking and analysis.

Derivatives Trading and Options

Crypto30x.com supports derivatives trading, including futures and options, offering sophisticated trading opportunities beyond spot trading.

Futures Trading:

- Long and Short Positions: With futures, traders can speculate on the future price of an asset, going long or short depending on market expectations. This provides opportunities to profit regardless of market direction.

- Leverage in Futures: Crypto30x.com allows traders to use leverage when trading futures contracts, further increasing potential returns while managing risk through stop-loss orders.

Options Trading:

- Call and Put Options: Traders can buy call options (the right to buy) or put options (the right to sell) on various cryptocurrencies. Options trading provides advanced traders with flexibility and risk management, especially in volatile markets.

- Hedging Strategies: Options are often used to hedge existing positions. For example, traders holding a large amount of cryptocurrency may buy put options to protect against a price drop.

Risk Management for Derivatives:

- Margin Requirements: Crypto30x.com ensures that traders meet margin requirements for futures and options contracts, reducing the risk of significant losses due to leverage.

- Risk Analysis Tools: Advanced traders can use real-time risk analysis tools that assess the volatility, liquidity, and price sensitivity (Greeks) of their derivatives positions, helping them manage complex portfolios effectively.

Advanced Risk Management Tools

For professional traders, managing risk is paramount, especially when using leverage or trading complex derivatives. Crypto30x.com provides advanced risk management tools to help mitigate potential losses while maximizing gains.

Position Sizing Calculators:

- Risk vs. Reward: Crypto30x.com offers position sizing calculators that help traders determine the optimal trade size based on their risk tolerance and reward expectations. This ensures that each trade is aligned with their overall risk management strategy.

- Leverage Risk: The platform includes built-in calculators that show the potential risks and rewards when using leverage, helping traders avoid overexposure to volatile assets.

Trailing Stop-Loss Orders:

- Dynamic Protection: Unlike standard stop-loss orders, trailing stop-loss orders adjust automatically as the asset’s price moves in your favor. This allows traders to lock in profits while keeping the position open for further gains.

- Volatility-Based Stops: For assets experiencing high volatility, Crypto30x.com offers volatility-based stop-loss orders, which adjust dynamically based on the asset’s recent price fluctuations. This prevents premature stop-outs due to normal price swings.

Advanced Portfolio Management and Analytics

Experienced traders often manage large portfolios across multiple cryptocurrencies and asset types. Crypto30x.com offers sophisticated portfolio management and analytics tools that help users track performance, manage risk, and optimize returns.

Portfolio Analysis Tools:

- Real-Time Profit and Loss Tracking: The platform provides live updates on the performance of your portfolio, showing unrealized gains and losses across all holdings. Users can break down performance by individual asset, sector, or trading strategy.

- Diversification Analysis: Crypto30x.com analyzes your portfolio’s exposure across different sectors, cryptocurrencies, and regions. It provides suggestions for rebalancing based on your risk tolerance and market conditions.

- Performance Benchmarks: Compare your portfolio’s performance against key market indices or benchmarks to see how your strategies are performing relative to the overall crypto market.

Tax and Regulatory Tools:

- Tax Reporting: For experienced traders dealing with high volumes, Crypto30x.com simplifies tax reporting by automatically calculating capital gains, losses, and taxable events. The platform integrates with major tax software to streamline the process.

- Compliance Tools: Crypto30x.com offers compliance tracking tools that help users adhere to regulatory requirements, including KYC/AML compliance for international traders.

7. Risk Management and Exit Strategies

In the volatile world of cryptocurrency trading, effective risk management and well-planned exit strategies are essential for long-term success. Crypto30x.com provides users with a variety of tools and methods to protect their capital while optimizing profits. This section will detail the critical elements of risk management, including diversification, stop-loss orders, position sizing, and how to set up exit strategies that maximize gains and limit losses.

The Importance of Risk Management

Cryptocurrencies are notorious for their rapid price fluctuations, which can lead to both significant gains and losses. Risk management is crucial for minimizing exposure to market downturns and protecting your portfolio. By carefully controlling risk, traders can ensure they remain in the game long enough to benefit from profitable opportunities.

Why Risk Management Matters:

- Preserving Capital: Without proper risk management, traders can quickly deplete their capital during periods of market volatility. Preserving capital allows traders to take advantage of future opportunities.

- Consistency Over Time: Successful traders focus on consistent, long-term growth rather than short-term wins. Risk management strategies help reduce the chance of catastrophic losses, ensuring that your portfolio can weather market fluctuations.

- Reducing Emotional Trading: Risk management takes the emotion out of trading decisions, as predefined rules guide when to exit a trade, limiting impulsive reactions to market swings.

Diversification Strategies

One of the most fundamental risk management techniques is diversification. Rather than concentrating all of your capital in one or two assets, diversification spreads risk across multiple cryptocurrencies, reducing the impact of any single asset’s poor performance.

How Diversification Works:

- Spreading Investments: Crypto30x.com allows users to build diversified portfolios by investing in a range of cryptocurrencies, including major coins like Bitcoin and Ethereum, as well as emerging altcoins in sectors like DeFi and NFTs.

- Sector-Based Diversification: Different sectors within the crypto market (e.g., decentralized finance, Layer-2 scaling solutions, non-fungible tokens) react differently to market events. Diversifying across sectors helps mitigate sector-specific risks.

- Stablecoins for Stability: Stablecoins, which are pegged to traditional currencies like the US dollar, offer traders a safe haven during periods of extreme volatility. Allocating part of your portfolio to stablecoins reduces overall risk without fully exiting the market.

Benefits of Diversification:

- Reduces overall portfolio risk by balancing exposure across multiple assets.

- Increases the chance of capturing growth in different areas of the cryptocurrency market.

- Provides a buffer against sharp declines in any single asset, sector, or market segment.

Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for protecting your trades and ensuring that you lock in gains or cut losses at predefined levels. These automated orders take the emotion out of trading and enforce discipline in your risk management strategy.

Stop-Loss Orders:

- How They Work: A stop-loss order automatically sells a cryptocurrency when its price falls to a predetermined level. This prevents losses from mounting further during market downturns.

- Trailing Stop-Loss: Crypto30x.com also offers trailing stop-loss orders, which adjust dynamically as the asset’s price rises. The trailing stop-loss follows the price upward and locks in profits, selling the asset if the price reverses.

- Key Advantages:

- Protects your portfolio from significant losses.

- Automatically enforces exit strategies without requiring constant market monitoring.

- Helps manage downside risk, especially in volatile markets.

Take-Profit Orders:

- How They Work: A take-profit order automatically sells an asset once it reaches a specified price, allowing traders to lock in profits at a predetermined level.

- Strategic Usage: Take-profit orders can be used to secure gains when the market experiences a rapid upswing, ensuring that traders don’t miss the opportunity to capitalize on short-term price spikes.

- Key Advantages:

- Locks in profits before the market has a chance to reverse.

- Reduces the temptation to hold positions for too long, which can lead to missed profit-taking opportunities.

- Helps achieve consistent gains over time.

Position Sizing and Calculators

Position sizing is the process of determining how much capital to allocate to a particular trade based on your risk tolerance and overall portfolio size. This strategy is crucial for managing risk, especially when trading in volatile markets.

Position Sizing Tools on Crypto30x.com:

- Risk vs. Reward Calculation: The platform offers built-in calculators that help traders determine the optimal position size based on their desired risk-to-reward ratio. By limiting the amount of capital at risk in any one trade, traders can protect their portfolios from significant losses.

- Leverage Considerations: For traders using leverage, position sizing becomes even more important. Crypto30x.com’s tools allow traders to account for leverage when calculating position sizes, ensuring they do not overexpose their portfolios to unnecessary risk.

Benefits of Position Sizing:

- Helps maintain consistency by ensuring that no single trade can cause excessive losses.

- Encourages disciplined trading practices by limiting risk exposure on each individual trade.

- Prevents over-leveraging, which can lead to significant losses if the market moves against your position.

Setting Realistic Profit Targets

Setting profit targets is an essential component of any exit strategy. Crypto30x.com provides traders with the tools needed to identify realistic profit targets based on technical and fundamental analysis.

How to Set Profit Targets:

- Technical Analysis Tools: Use technical analysis tools such as support and resistance levels, Fibonacci retracement, and moving averages to identify price levels where it makes sense to take profits.

- Historical Price Action: Review the historical performance of a cryptocurrency to identify trends and patterns that indicate when a price might reverse or consolidate.

- Market Conditions: Take into account broader market conditions, such as market sentiment, economic news, and sector trends, to set realistic profit goals.

Take-Profit Strategies:

- Partial Profit-Taking: Some traders choose to take partial profits at multiple price levels, locking in gains while leaving part of the position open to capitalize on further price movement.

- All-in Profit-Taking: Others prefer to set a single take-profit target and exit the trade entirely once it’s hit. This approach is simpler but carries the risk of missing out on potential future gains.

Exit Strategies: Knowing When to Close a Trade

Knowing when to exit a trade is just as important as knowing when to enter. Crypto30x.com offers several tools and strategies to help traders develop effective exit strategies.

Technical Exit Strategies:

- Trend Reversal Signals: Indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and candlestick patterns can signal when a trend is about to reverse, making it a good time to exit.

- Moving Averages: Many traders use moving averages (e.g., 50-day or 200-day) to determine when a cryptocurrency’s price has moved below a critical support level, indicating it’s time to close the trade.

Fundamental Exit Strategies:

- News and Events: Crypto30x.com’s news feed and sentiment analysis tools allow traders to exit positions based on important market events, such as regulatory changes or negative news about a specific cryptocurrency.

- Development and Roadmaps: If a cryptocurrency’s development stagnates or its roadmap is not progressing as expected, it may be time to consider exiting the trade, even if the price hasn’t yet declined.

Combining Risk Management and Exit Strategies

The most successful traders combine multiple risk management and exit strategies to create a robust trading plan. Crypto30x.com allows traders to integrate these strategies seamlessly into their portfolios, ensuring that each trade is executed with discipline and precision.

Key Components of a Comprehensive Strategy:

- Diversification: Spread investments across different cryptocurrencies and sectors to minimize exposure to any single asset’s performance.

- Stop-Loss and Take-Profit Orders: Use stop-loss orders to protect against downside risk and take-profit orders to secure gains automatically.

- Position Sizing: Calculate position sizes to ensure you’re not risking too much capital on any one trade, especially when using leverage.

- Exit Planning: Develop exit strategies based on technical and fundamental analysis, ensuring you know when to lock in profits or cut losses.

8. Frequently Asked Questions (FAQs)

As more traders and investors explore Crypto30x.com, a few common questions naturally arise. Below are answers to the most frequently asked questions about the platform, addressing everything from safety and fees to mobile compatibility and customer support.

Q: Is Crypto30x.com a safe and reliable platform?

Yes, Crypto30x.com is a highly secure and reliable platform for cryptocurrency trading. The platform uses advanced encryption protocols to safeguard user data and funds. Additionally, it employs two-factor authentication (2FA) to add an extra layer of security for user accounts. Crypto30x.com is compliant with industry regulations and implements strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to prevent fraud and ensure a safe trading environment.

Q: Can I use Crypto30x.com on my mobile device?

Absolutely! Crypto30x.com is fully optimized for mobile devices, allowing users to access their accounts, monitor the market, and place trades on the go. The platform is compatible with both iOS and Android devices through a dedicated app, which provides the same functionality as the desktop version. Whether you’re using a smartphone or tablet, the mobile interface is user-friendly and designed for seamless trading.

Q: Are there any fees associated with using Crypto30x.com?

Crypto30x.com charges competitive fees for trading, deposits, and withdrawals. The platform’s fee structure is transparent, with no hidden charges. Fees include:

- Trading Fees: A small percentage of each trade (buy or sell) is charged as a fee. This fee may vary depending on the type of order and the trading volume.

- Withdrawal Fees: A fixed fee applies to withdrawals, which is dependent on the cryptocurrency being withdrawn.

- Leverage Fees: For those using leveraged trading, there are interest fees on borrowed funds, which are competitive within the market.

The platform also offers discounts on trading fees for users who hold specific amounts of certain cryptocurrencies (like the platform’s native token, if available).

Q: Can I receive customer support from Crypto30x.com?

Yes, Crypto30x.com provides excellent customer support to ensure a smooth trading experience. Users can access 24/7 customer service through live chat, email support, and an extensive help center filled with guides and tutorials. For urgent queries, the live chat feature offers quick resolutions, while email support addresses more detailed questions or issues. The platform also offers an FAQ section for addressing common questions about account setup, trading, and security.

Q: Is it necessary to have prior experience in cryptocurrency trading to use Crypto30x.com?

No prior experience is necessary to start using Crypto30x.com. The platform is designed for both beginners and experienced traders. For those new to cryptocurrency, the platform provides educational resources, including tutorials, videos, and a demo account for practice. Beginners can start trading with minimal capital, while advanced traders can take advantage of the platform’s sophisticated tools and features.

9. Success Stories and Testimonials

The ultimate measure of any trading platform is its users’ success. Crypto30x.com has been instrumental in helping both beginners and seasoned traders achieve impressive returns. In this section, we’ll explore some real-life examples of how the platform has supported users in their journey toward substantial gains.

Case Study 1: A Beginner’s Journey to 10x Returns

Background: Sarah, a novice investor, joined Crypto30x.com with little knowledge of cryptocurrency. She initially started small, funding her account with just $500 to explore the market. Sarah took advantage of the educational tools, including tutorials on technical analysis and risk management, to build her confidence in trading.

The Strategy: Using the platform’s automated alerts and research tools, Sarah identified an emerging altcoin in the DeFi space that showed potential for growth. She set stop-loss and take-profit orders to manage her risk, ensuring that her capital was protected while aiming for substantial gains.

The Results: Within six months, the value of her investment increased tenfold, reaching $5,000. By following the guidance provided by Crypto30x.com and sticking to her strategy, Sarah achieved these impressive gains while managing her risk responsibly.

Case Study 2: An Experienced Trader Reaches 25x Gains

Background: John, an experienced trader with a background in stock trading, switched to cryptocurrency due to its higher volatility and potential for greater returns. He joined Crypto30x.com to leverage its advanced technical analysis tools and gain an edge in the fast-paced crypto market.

The Strategy: John used leveraged trading on Crypto30x.com to maximize his returns in a rapidly rising altcoin market. By applying moving averages, Fibonacci retracements, and RSI indicators, he was able to identify optimal entry and exit points. He also used API integration to execute automated trades based on his custom-built algorithm.

The Results: Over the course of a year, John achieved a 25x return on his initial investment. His success was driven by disciplined trading, use of the platform’s leverage options, and a deep understanding of market cycles, which he was able to track through Crypto30x.com’s advanced charting tools.

Case Study 3: A Diversified Portfolio Yields Consistent Returns

Background: Emily, a long-term investor with a conservative approach, wanted to diversify her holdings across different sectors of the crypto market. She used Crypto30x.com to explore assets outside of the top coins and focus on sector-based diversification.

The Strategy: Emily invested in a mix of altcoins, including those in the DeFi, NFT, and Layer-2 sectors. By using the platform’s portfolio management tools and regularly rebalancing her investments, she was able to capture gains from different market sectors without overexposing her portfolio to any single asset.

The Results: Over 18 months, Emily saw a steady increase in her portfolio’s value, averaging a 15x return across her diversified assets. By balancing her exposure and using risk management tools like stop-loss orders, Emily achieved consistent results while minimizing her risk in a volatile market.

10. Conclusion: Why Crypto30x.com Is a Game-Changer for Crypto Investors

Crypto30x.com has established itself as one of the leading platforms for both beginner and advanced cryptocurrency traders. Its comprehensive suite of tools, user-friendly interface, and sophisticated trading features empower users to pursue substantial gains while managing risks effectively. Whether you’re just starting out in the crypto world or a seasoned trader looking for advanced analytics and leveraged trading, Crypto30x.com provides the flexibility and resources needed to succeed.

Key Takeaways:

- Advanced Features: Tools like leveraged trading, advanced charting, and automated trading strategies cater to experienced traders looking to maximize profits.

- Comprehensive Risk Management: Features such as stop-loss and take-profit orders, position sizing calculators, and sector-based diversification help traders manage risk in a volatile market.

- Educational Resources: Beginners can benefit from detailed tutorials, a demo account, and personalized support, making the platform accessible to those new to crypto trading.

- User Success: With real-life case studies demonstrating impressive returns, Crypto30x.com proves that its tools and strategies can deliver meaningful results for investors of all levels.

conclusion

In conclusion, Crypto30x.com stands out as a comprehensive platform that empowers both novice and experienced traders to navigate the dynamic cryptocurrency market with confidence. With its advanced features, robust risk management tools, and user-friendly interface, the platform offers everything needed to pursue significant gains while minimizing risk. Whether you’re just getting started with crypto or you’re a seasoned trader looking to enhance your strategies, Crypto30x.com provides the resources, guidance, and support to help you achieve your financial goals. By combining cutting-edge technology with practical tools, Crypto30x.com is truly a game-changer for anyone looking to capitalize on the vast opportunities within the crypto space. Now is the time to take the next step in your trading journey with Crypto30x.com.